Published

- Sustainability

- Financing

Megaproject will harness gales off the Scottish coast to power UK homes

Backed by one of EKN’s largest Green Export Credit Guarantees to date, and featuring Swedish technology from Hitachi Energy, the UK’s largest-ever electricity transmission project will deliver Scottish offshore wind power to around two million households. “ECA financing brings flexibility, diversification and longer tenors.”

Project overview: bringing Scottish offshore wind to UK homes

Scotland is rapidly emerging as a global leader in offshore wind energy, a technology vital to the world’s transition to net zero carbon emissions. To reach net zero by 2050, the Global Wind Energy Council forecasts that offshore wind will need to account for around 25 per cent of global power generation. This would require global capacity to rise from roughly 30 GW today to 450 GW by 2030.

Highly favourable wind conditions in the North Sea, combined with Scotland’s extensive offshore expertise and Swedish know-how in transmission technology, will enable the production and transport of the equivalent output of two nuclear power plants (2 GW) to around two million UK households through a project known as EGL2 (Eastern Green Link 2).

Export finance is a highly competitive tool, offering long durations at attractive rates, which is beneficial for this project and allows for longer payback time.

Niklas Persson, Managing Director of the Grid Integration business unit, Hitachi Energy

Generating power on that scale requires several hundred wind turbines located far offshore, where winds are strongest. Transmitting the electricity to land and integrating it into the national grid requires conversion from AC to DC and back again, using two high-voltage direct current (HVDC) converter stations that interconnect the Scottish and English power systems—one in Peterhead, Aberdeenshire, and one in Drax, North Yorkshire.

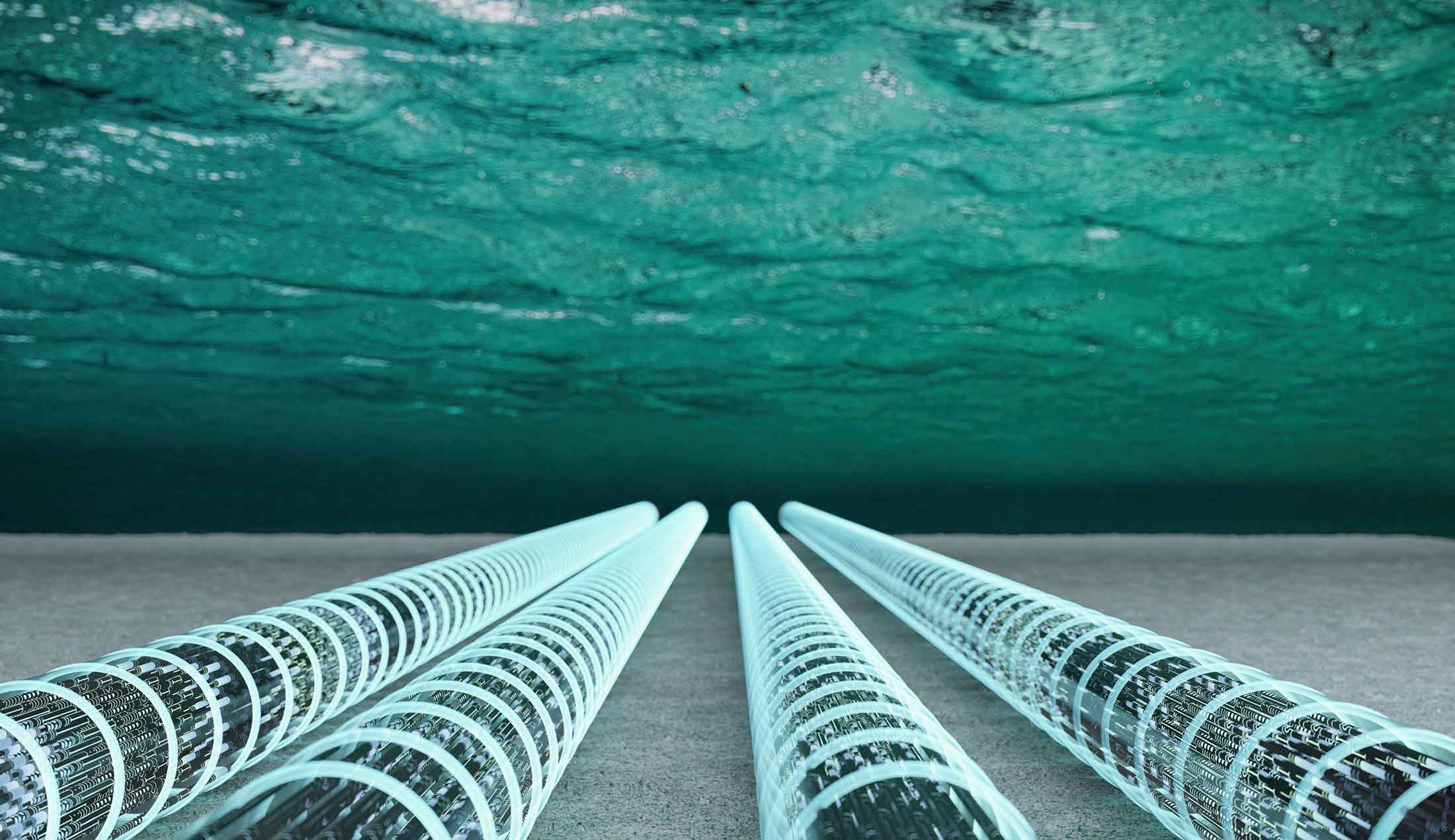

Provided by Sweden-based Hitachi Energy, the converter stations are linked by 436 km of subsea cable and 69 km of underground cable, making EGL2 the UK’s longest HVDC link. A joint venture between National Grid Electricity Transmission and SSEN Transmission, the project will support the decarbonisation of the UK’s electricity network as part of the Government’s Net Zero strategy.

Long-distance transmission of renewable energy

Financing for National Grid’s portion of EGL2 was arranged by BNP Paribas and Société Générale, with refinancing from SEK and cover from EKN for a total of just over USD 1 billion over 19.5 years—equivalent to around 30 per cent of National Grid’s project cost.

Hitachi Energy is a world leader in HVDC technology, which is essential for long-distance transmission of renewable power and for interconnection with national grids.

This is one of the first green export credit guarantees issued by EKN, and among the largest to date.

Lena Bertilsson, Head of Business Area Large Corporates, EKN

Niklas Persson, Managing Director of the Grid Integration business unit at Hitachi Energy, explains why offshore wind power needs to be converted: “HVDC was developed for long-distance transmission of energy, since only 1 percent of the energy transmitted via DC is lost along the way, whereas AC loses 10 percent and becomes physically impossible beyond 130 km. Our solution creates a stable and reliable energy supply with maintained frequency in a setting where highly variable wind conditions lead to strong current fluctuations.”

Hitachi Energy traces its history and the technological innovation behind HVDC back to Swedish Asea, which merged with Swiss Brown Boveri in 1987 to become the ‘A’ in ABB and a part of Hitachi ABB Power Grids in 2020.

Persson notes that time is critical to the success of the energy transition. “Offshore wind and solar projects take up to seven years from project start to production, while new hydropower takes 10 years and nuclear 13. The cost per MWh and the limited environmental impact from wind and solar are also unbeatable.”

Alignment with EU Taxonomy rules covering electricity transmission and distribution paved the way for EGL2 to qualify for a Green Export Credit Guarantee from EKN. Lena Bertilsson, Head of Business Area Large Corporates, hails it as a landmark transaction. “This is one of the first green export credit guarantees issued by EKN, and among the largest to date. EKN is happy to be supporting investment grade lending for a green project of this magnitude.”

The ability to structure large ECA facilities is a key factor of interest for sophisticated borrowers such as National Grid.

Agnès Deschênes Voirin, Head of the Export Finance Scandinavian Desk, Société Générale

“We are proud to support the ambitious goal of the UK to be fully powered with green electricity by 2035, on the pathway to net zero by 2050,” adds Synnöwe Krensler, Senior Underwriter at EKN.

“Export finance is a highly competitive tool”

At Hitachi Energy, Persson believes EKN’s support has been imperative to the deal. “We are very comfortable with the financial close of a project of this magnitude. Export finance is a highly competitive tool, offering long durations at attractive rates, which is beneficial for this project and allows for longer payback time.”

The project’s green classification also supported BNP Paribas’ decision to participate, argues Valentyna Kryva, Director, Export Finance Nordic Region. “Green assets are in high demand with investors and lenders, and the green classification has an impact on the pricing as well as the appetite for this type of project. BNP Paribas has been supporting grid interconnection projects for ten years, but EGL2 is the biggest so far and will contribute to the decarbonization of energy-intensive industries.”

Looking ahead, Kryva believes green assets should be subject to lower premiums. “This project would have been a perfect candidate and I am convinced that the OECD common framework will allow for preferential treatment of green projects in the future.”

EKN is considered one of the most flexible ECAs out there.

Valentyna Kryva, Director, Export Finance Nordic Region, BNP Paribas

At Société Générale, Agnès Deschênes Voirin, Head of the Export Finance Scandinavian Desk agrees that the green classification helped create a certain buzz around EGL2. “We are happy to support projects that are part of a net-zero strategy. The presence of Nordic content as well as the flexibility of EKN created the opportunity to structure a large EKN facility and thus offer a material diversification funding tool to National Grid. The ability to structure large ECA facilities is a key factor of interest for sophisticated borrowers such as National Grid.”

Top-rated borrowers opt for ECA financing

Both Kryva and Deschênes Voirin view ECA financing as an effective way to diversify funding of large projects, even in high-income countries and for top-rated borrowers who would otherwise have no problem raising debt on the bond market. National Grid Electricity Transmission holds a BBB+ rating.

“Another strong benefit of ECA financing is that it can be tailored to the commercial contracts of the project and you can draw on the facility to match payments to the suppliers,” says Kryva.

Deschênes Voirin believes ECAs can play a catalytic role in the energy transition—an agenda that will require huge investment and capex in the years ahead—given their ability to support large financing volumes, extend the availability period, and offer longer repayment terms. “ECA financing brings flexibility, diversification and longer tenors.”

The project has been refinanced by SEK and guaranteed by EKN, to which Deschênes Voirin comments: “The strength of the EKN/SEK combination lies in its ability to maximise the financed amount. Having two arranging banks makes for efficient financing and demonstrates agility vis-à-vis the client.”

Reliable flow of electricity

Regarding cooperation with EKN/SEK, Deschênes Voirin says: ‘It is always a pleasure to experience flexibility and a willingness to push the boundaries of the structure.” Kryva adds that “EKN is considered one of the most flexible ECAs out there.”

TSOs in Europe are facing enormous investment challenges that may be difficult to fund solely on the commercial capital market.

Marica Bixo, Director Global Trade and Export Finance, SEK

At SEK, Marica Bixo, Director Global Trade and Export Finance says, “It is incredibly exciting and valuable for us to be a part of this project and to support Swedish contributions to the energy transition in Europe.”

Having EKN on board means a lot to SEK, she adds, particularly when it comes to projects of this size. “With cover from EKN, the amount we are able to lend is not restricted by the credit limit of a given client.”

Bixo believes the size and scope of EGL2 highlights the challenges brought on by the energy transition. “Transmission System Operators (TSOs) in Europe are facing enormous investment challenges that may be difficult to fund solely on the commercial capital market.”

For Hitachi Energy, the drive to connect national grids across Europe—ensuring stable electricity flows from intermittent renewable sources such as wind and solar—is an important business driver. Long-distance electricity sharing is essential because weather conditions vary across regions and countries. Since it is usually sunny or windy somewhere in Europe, renewables in different locations can complement one another to help ensure reliable power flows through interconnected grids.

The construction of EGL2 began in 2024 and is expected to be completed in 2029.

Related reading for exporters

- Risk

- Export support

EKN expertise settles unpaid debt worldwide

Expert help when overseas buyers fail to pay. EKN supports exporters with settlement strategies and debt recovery worldwide.

EKN expertise settles unpaid debt worldwide

- Success stories

- Guarantees

Building a world-class export credit system

EKN’s new Director General Åke Nordlander outlines his vision for a stronger, more sustainable export credit system.

Building a world-class export credit system

- Financing

TDC surges ahead: first Danish telecom deal backed by EKN

“What EKN has done is fantastic. As far as I know this is the first-ever ECA facility on a WBS ring-fenced structure.”

TDC surges ahead: first Danish telecom deal backed by EKN

EKN for buyers in Swedish export transactions

Buy from Sweden and benefit from attractive financing.

EKN for buyers in Swedish export transactions

EKN for large corporates

More and bigger export transactions for companies with an annual turnover of more than SEK five billion.

EKN for large corporates