Published

- Markets

- Trends

Global race for critical materials benefits Nordic cluster

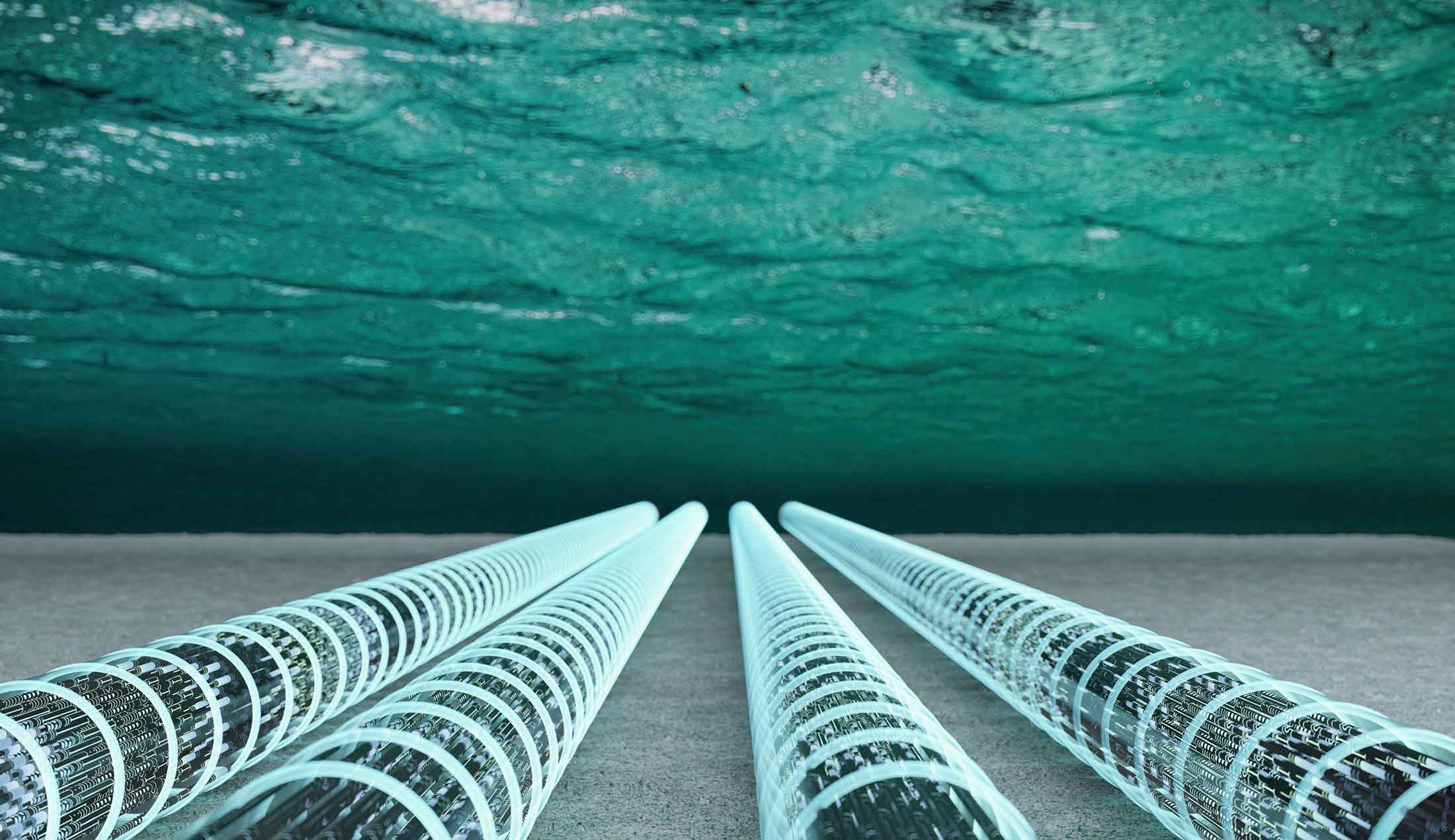

The mining industry plays a pivotal role in the global energy transition, which depends on a handful of critical metals and minerals. With suppliers spanning the entire value chain, the Nordic region is exceptionally well positioned to lead the shift towards sustainable mining.

Why the Nordic mining cluster matters in the global transition

Minerals such as copper, lithium, nickel and cobalt are essential for today’s rapidly expanding clean-energy technologies—from electric vehicles to power grids connecting wind and solar power. The International Energy Agency (IEA) estimates that demand for critical minerals must triple by 2030 and quadruple by 2040 to achieve net-zero emissions. In total, more than three billion tonnes of transition minerals will be required to deploy wind, solar and large-scale energy storage.

The global race for critical minerals has intensified with rising production of EVs, batteries, clean-energy systems and defence equipment.

Lena Bertilsson, Head of Large Corporates at EKN

At the GTR Nordics 2025 conference in Stockholm, EKN hosted a panel discussion on how the Nordic mining cluster can deliver sustainable, cutting-edge solutions to meet soaring global demand for strategic metals.

“The global race for critical minerals has intensified with rising production of EVs, batteries, clean-energy systems and defence equipment,” said Lena Bertilsson, Head of Large Corporates at EKN. “Financing and investment in sustainable value chains is critically important.”

A cohesive ecosystem built on trust, talent and technology

The Nordic mining cluster spans the entire value chain—from exploration, extraction and smelting to processing and recycling. Mining equipment and rock-crushing technologies represemt another key strength: around 70 percent of the world’s underground mining equipment is manufactured in Finland and Sweden.

We operate like a family, developing tomorrow’s technologies together.

Micaela Löwenhöök, Head of Public Affairs at Boliden

The Nordic mining cluster spans the entire value chain—from exploration, extraction and smelting to processing and recycling. Mining equipment and rock-crushing technologies represent another key strength: around 70 per cent of the world’s underground mining equipment is manufactured in Finland and Sweden.

“Nordic suppliers are flexible front runners when it comes to next-generation technology and efficient operations,” said Micaela Löwenhöök, Head of Public Affairs at mining operator Boliden. She credits much of the success to a culture of trust and close collaboration—even among competitors. “We operate like a family, developing tomorrow’s technologies together.”

Proximity to end users significantly accelerates product development.

Håkan Folin, CFO at Epiroc

Håkan Folin, CFO at mining equipment producer Epiroc, highlighted the advantages of such a tightly interconnected ecosystem. “There is a constant exchange of skills and people across the value chain, and extensive cooperation among suppliers. Proximity to end users significantly accelerates product development.”

A recent milestone underscores this collaborative strength: Boliden, Epiroc and ABB have successfully deployed the world’s first fully battery-electric trolley-truck system on a 5-km track in Sweden. “This takes the industry a step closer to realising the all-electric mine of the future—with more sustainable, productive operations and improved working conditions,” Folin added.

Yet Löwenhöök offered a reminder: the sector relies on a strong research community. “Mining disciplines are receiving less attention in academia, partly due to declining interest among students and PhD candidates,” she warned.

Policy bottlenecks and financing challenges

The EU is working to raise the strategic profile of raw materials and reduce dependence on a small number of external suppliers. The EU Critical Raw Materials Act includes 47 projects across Europe—nine of them in the Nordics. “The Act is a positive development and a recognition of our industry,” said Löwenhöök. “But it lacks the power to push through legislation that would actually enable more mining.”

Metals and mining have always been a niche sector for banks.

Matthias Winkeler, Director Metals and Mining at ING in Frankfurt

Folin cautioned against “over-regulation” and stressed the need to speed up permitting and approvals for new mines. “It’s important that new EU directives don’t put us at a disadvantage compared with competitors elsewhere. Permitting takes far longer in Europe than in most other regions.” A rapid rejection is preferable to prolonged uncertainty, he said: “A quick no is better than a drawn-out maybe.”

Löwenhöök noted that Europe’s potential remains underutilised. “Take the rare-earth mineral tellurium. In theory, Europe could supply half of global demand, but China remains the sole supplier and sets prices accordingly.”

Matthias Winkeler, Director Metals and Mining at ING in Frankfurt, agreed that opening a mine is challenging across Europe. “In Germany it’s almost impossible—due to long permitting processes and dense population compared with the Nordics.”

ECAs overcome financing hurdle

Financing presents an additional hurdle. “Metals and mining have always been a niche sector for banks,” Winkeler said. “Volatile prices and perceived sustainability risks deter many commercial lenders.” Extraction of metals such as copper is somewhat easier to finance due to stable pricing and strong demand forecasts.

The more unstable or challenging a country is, the more essential ECA support becomes.

Jussi Haarasilta, Director Large Corporates at Finnvera

Against this backdrop, export credit agencies (ECAs) are playing an increasingly important role. “ECAs are taking on more mining projects, and we do need to assume more risk,” said Jussi Haarasilta, Director Large Corporates at Finnvera. “The more unstable or challenging a country is, the more essential ECA support becomes.” Sustainable mining practices are crucial for attracting funding—an area in which Nordic suppliers excel.

“European policymakers I meet are consistently impressed by the reputation of Nordic mining players,” Löwenhöök added.

Ultimately, the question is not whether more metals will be extracted—but where. “In Europe or elsewhere. It will happen regardless,” Löwenhöök concluded.

Related reading for exporters

- Financing

- Guarantees

Finno-Swedish ECA collaboration ready to take on bigger tickets

Finland and Sweden team up through Finnvera and EKN to support larger, multi-sourced projects with attractive financing.

Finno-Swedish ECA collaboration ready to take on bigger tickets

- Sustainability

- Financing

Megaproject will harness gales off the Scottish coast to power UK homes

UK’s longest HVDC link will carry Scottish offshore wind power to two million homes—backed by EKN and Swedish technology.

Megaproject will harness gales off the Scottish coast to power UK homes

- Risk

- Export support

EKN expertise settles unpaid debt worldwide

Expert help when overseas buyers fail to pay. EKN supports exporters with settlement strategies and debt recovery worldwide.

EKN expertise settles unpaid debt worldwide

EKN for large corporates

More and bigger export transactions for companies with an annual turnover of more than SEK five billion.

EKN for large corporates

EKN for buyers in Swedish export transactions

Buy from Sweden and benefit from attractive financing.

EKN for buyers in Swedish export transactions